China Industrial Economics Run 2009 Spring Report

In the second half of last year, especially in the fourth quarter, affected by unfavorable factors such as the international financial crisis, China's industrial economy is facing increasing downward pressure, and some industries and enterprises are in trouble. In order to prevent the economic growth from falling too fast, the Chinese government quickly launched a package plan to expand domestic demand and promote economic growth, and formulated and introduced ten key industrial adjustment and revitalization plans for steel and automobiles. These measures have alleviated the prominent contradictions in economic operations. It has played a vital role in enhancing confidence, stabilizing expectations, and maintaining stable and rapid economic development. From the economic operation situation in the first four months of this year, the industrial growth rate showed a low level and stabilized operation trend. The momentum of rapid decline in production in some regions and industries was initially contained. The ability of enterprises to cope with the impact of the crisis and adapt to market changes was improved. Positive direction transformation.

At the same time, the situation facing the operation of the industrial economy is still complicated and grim. From the perspective of the internal and external environment of economic operation, this year will be the most difficult year for China's industry to enter the new century. Although there have been some positive changes in the economic operation, the foundation is still not solid, and the industry is “guaranteeing growth, adjusting structure and The level of the task is very difficult.

I. Basic Situation of Industrial Economic Operation in the First Four Months (I) The momentum of sharp decline in industrial growth rate was initially contained, and the overall operation was shifting towards a positive direction.

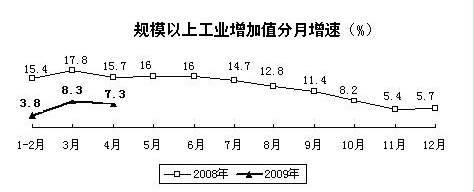

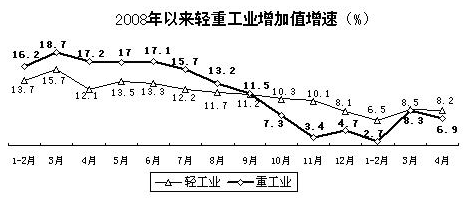

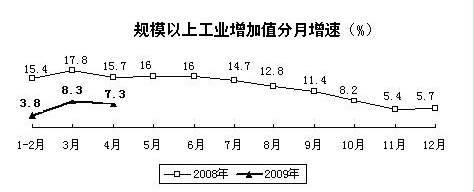

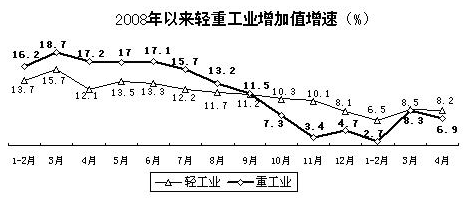

From January to April, the added value of industrial enterprises above designated size increased by 5.5% year-on-year, of which 5.1% in the first quarter was the lowest growth rate in the past 15 years. From the monthly operating situation, the first two months increased by 3.8%, the lowest point since the second half of last year; the growth rate in March and April respectively rose back to 8.3% and 7.3%, both higher than last November and December growth. Level. The operation in the first four months shows that the central government's series of policies and measures to expand domestic demand and maintain growth have achieved initial results, and the industrial economy has shown positive changes. 1. Light industry operations are basically stable, and heavy industry has risen from down. From January to April, the added value of light and heavy industries increased by 7% and 4.9% respectively. The growth rate of light and heavy industries experienced a continuous decline since the second half of last year. It fell to a low of 6.5% and 2.7% in the first two months of this year, and then a different degree of recovery. In 3 and 4 months, the growth rate of light industry rebounded to 8.5% and 8.2%, and heavy industry rebounded to 8.3% and 6.9%. From the overall operational situation, the light industry is mainly driven by the rigid consumption demand, the degree of decline is shallow, and the production situation is relatively stable. After heavy industry has undergone more than half a year of adjustment, the raw materials purchased at high prices in the early period have been basically digested, and the product inventory has basically returned to normal levels. In addition, the purchase price of raw materials, fuels and power has decreased, and the operating conditions have improved.

1. Light industry operations are basically stable, and heavy industry has risen from down. From January to April, the added value of light and heavy industries increased by 7% and 4.9% respectively. The growth rate of light and heavy industries experienced a continuous decline since the second half of last year. It fell to a low of 6.5% and 2.7% in the first two months of this year, and then a different degree of recovery. In 3 and 4 months, the growth rate of light industry rebounded to 8.5% and 8.2%, and heavy industry rebounded to 8.3% and 6.9%. From the overall operational situation, the light industry is mainly driven by the rigid consumption demand, the degree of decline is shallow, and the production situation is relatively stable. After heavy industry has undergone more than half a year of adjustment, the raw materials purchased at high prices in the early period have been basically digested, and the product inventory has basically returned to normal levels. In addition, the purchase price of raw materials, fuels and power has decreased, and the operating conditions have improved.  2. The decline in the benefits has improved, and the “two funds†occupancy rate has declined. In the first quarter, the province's 22 provinces with statistical industrial benefits achieved a total profit of 322.7 billion yuan, a year-on-year decrease of 32.2%, a decrease of 7.3 percentage points over the previous two months. At the end of March, the funds occupied by industrial accounts receivable and finished goods inventory in 22 provinces increased by 7% and 10.4% respectively, which was 0.4 and 3.6 percentage points lower than the previous two months. The improvement of the efficiency situation will further alleviate the pressure on the production and operation of enterprises.

2. The decline in the benefits has improved, and the “two funds†occupancy rate has declined. In the first quarter, the province's 22 provinces with statistical industrial benefits achieved a total profit of 322.7 billion yuan, a year-on-year decrease of 32.2%, a decrease of 7.3 percentage points over the previous two months. At the end of March, the funds occupied by industrial accounts receivable and finished goods inventory in 22 provinces increased by 7% and 10.4% respectively, which was 0.4 and 3.6 percentage points lower than the previous two months. The improvement of the efficiency situation will further alleviate the pressure on the production and operation of enterprises.

3. Production recovery in most provinces accelerated, and the recovery in the eastern region was obvious. In April, the industrial growth rate of 21 provinces in the country increased or decreased in different degrees from the first quarter. Among the major industrial provinces, Shandong, Jiangsu and Guangdong provinces, which accounted for 14%, 12.2% and 10.5% of the national industrial added value, grew at a rate of 14.1%, 14.4% and 3.5% respectively, up 7.6 and 3.8 from the first quarter. 2.6 percentage points; Zhejiang Province's monthly added value, which accounted for 5.6% of the national industrial added value, changed from a 5.6% decline in the first quarter to a 0.2% increase; the monthly growth rate of Henan and Liaoning provinces, which accounted for 5.4% and 5.3% of the national industrial added value. They were 7.3% and 12% respectively, up 4.2 and 0.8 percentage points from the first quarter. In the same month, the industrial added value of the eastern, central and western regions increased by 6.7%, 5.5% and 12.7% respectively, which was 3, 0.3 and 0.9 percentage points higher than the first quarter. Relatively speaking, the impact of the international financial crisis on the industrial development in the eastern part of China is earlier and to a greater extent. The industrial base in the eastern region is good and the scale is large. The rapid recovery of its production situation will lay a foundation for the steady recovery of the national industrial growth rate. Good foundation.

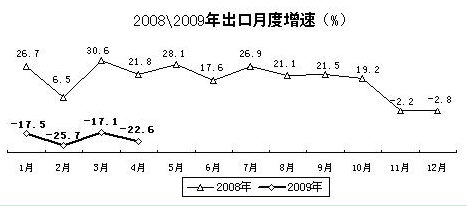

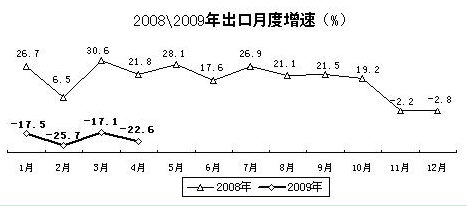

4. The policy role of adjusting the export tax rebate rate appears. According to customs statistics, from January to April, China’s foreign trade exports were US$337.4 billion, down 20.5% year-on-year; of which exports were US$91.9 billion in April, down 22.6%, a decrease of 5.4 percentage points from March, based on the average working day, and exported in the same month. It is 6.8% higher than in March. Since the second half of last year, the country’s exports of export tax rebates have been increased by 48.7 billion U.S. dollars in April, down 18.6% year-on-year, which is lower than the overall national export decline of 4 percentage points. The export value accounted for 52.8% of the national export value of the month; On average, the working day, the export of the month increased by 9.4% compared with March. Among the major exporting provinces, Guangdong, Zhejiang, Shandong, Fujian, and Beijing (the export accounted for 57% of the national total) fell by 12.9%-20.3% in the month, which was less than the national average. 5. Industrial investment grew steadily, and technological transformation of enterprises progressed steadily. From January to April, the national urban fixed asset investment increased by 30.5% year-on-year, of which the investment in industry was 1,569.8 billion yuan, an increase of 27.7%, accounting for 42.3% of the national urban fixed assets investment. In fixed asset investment, construction and installation engineering investment and equipment and equipment purchase costs increased by 33.1% and 31.1% respectively. This year, the central government's 20 billion yuan technical transformation special fund project declaration and approval work has been steadily advanced, more than 70% of the plan has been issued, and the total investment of the project exceeds 200 billion yuan. Since the beginning of this year, the strong growth of fixed asset investment has not only formed a strong pulling effect on the raw material industry and equipment manufacturing industry, but also the rapid growth of industrial direct investment will further enhance the stamina of industrial development.

5. Industrial investment grew steadily, and technological transformation of enterprises progressed steadily. From January to April, the national urban fixed asset investment increased by 30.5% year-on-year, of which the investment in industry was 1,569.8 billion yuan, an increase of 27.7%, accounting for 42.3% of the national urban fixed assets investment. In fixed asset investment, construction and installation engineering investment and equipment and equipment purchase costs increased by 33.1% and 31.1% respectively. This year, the central government's 20 billion yuan technical transformation special fund project declaration and approval work has been steadily advanced, more than 70% of the plan has been issued, and the total investment of the project exceeds 200 billion yuan. Since the beginning of this year, the strong growth of fixed asset investment has not only formed a strong pulling effect on the raw material industry and equipment manufacturing industry, but also the rapid growth of industrial direct investment will further enhance the stamina of industrial development.  6. The comprehensive energy consumption level has decreased, and the energy efficiency of key energy-consuming enterprises has increased. In the first quarter, the comprehensive energy consumption of industrial enterprises above designated size was 489 million tons, down 6.2% year-on-year, accounting for 74% of the total national energy consumption. Among the 39 industrial categories, 29 were reduced in comprehensive energy consumption, of which 10% fell. There are 9 above; the energy consumption of industrial units has decreased by 10.8% year-on-year. Energy consumption indicators of key energy-consuming enterprises continue to decrease, and energy utilization efficiency is improved. According to the statistics on energy consumption of industrial enterprises with an annual comprehensive energy consumption of 10,000 tons of standard coal and above, in the 53 products or processes, there were 41 kinds of comprehensive energy consumption decreased in the first quarter, and 12 of them increased, accounting for 77% respectively. And 23%; the energy used for energy recovery reaches 19.35 million tons of standard coal, and the recovery utilization rate is 2.25%.

6. The comprehensive energy consumption level has decreased, and the energy efficiency of key energy-consuming enterprises has increased. In the first quarter, the comprehensive energy consumption of industrial enterprises above designated size was 489 million tons, down 6.2% year-on-year, accounting for 74% of the total national energy consumption. Among the 39 industrial categories, 29 were reduced in comprehensive energy consumption, of which 10% fell. There are 9 above; the energy consumption of industrial units has decreased by 10.8% year-on-year. Energy consumption indicators of key energy-consuming enterprises continue to decrease, and energy utilization efficiency is improved. According to the statistics on energy consumption of industrial enterprises with an annual comprehensive energy consumption of 10,000 tons of standard coal and above, in the 53 products or processes, there were 41 kinds of comprehensive energy consumption decreased in the first quarter, and 12 of them increased, accounting for 77% respectively. And 23%; the energy used for energy recovery reaches 19.35 million tons of standard coal, and the recovery utilization rate is 2.25%.

(2) The policy effect of expanding domestic demand has gradually emerged, and some industries have stabilized and rebounded during the adjustment.

1. In the first four months of the raw material industry, the added value of the raw materials industry increased by 5.3% year-on-year, with an increase of 7% in April. In the major industries, the metallurgical, non-ferrous, building materials and chemical industries increased by 1%, 4%, 12.8% and 6.1% respectively. The added value of the four industries accounted for 10%, 3.4%, 5.2% and 6.9% of the total industrial added value respectively. , a total of 25.5%.

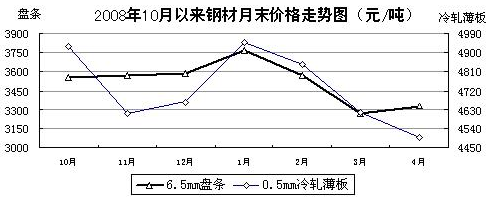

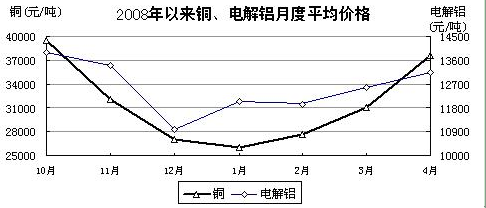

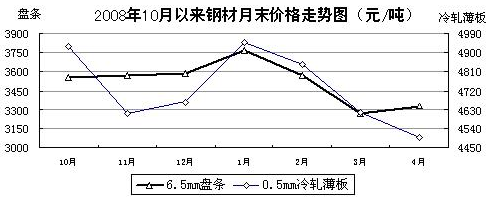

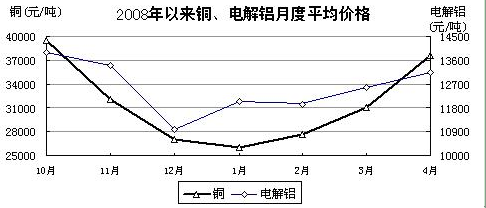

The steel industry as a whole is in a shock adjustment. In the first quarter, global crude steel output fell by 22.8% year-on-year. Under the policy of expanding domestic demand, the market supply and demand situation improved. The crude steel output in the first four months was 174.67 million tons, which was basically the same as the same period of last year. The output was maintained at 1.45 million tons / day. Long products grew faster and the plates were relatively weak. Affected by the sharp drop in international market prices and oversupply in the domestic market, steel prices are generally at a low level, and the entire industry is at a loss. According to the statistics of the China Iron and Steel Association, at the end of April, the comprehensive price index of steel products in the domestic market was 95.56, lower than the lowest point in November last year. Recently, with the decline in inventories and the increase in demand, the domestic steel market price has also gone out for 10 consecutive weeks. It has been on the rise for five consecutive weeks until May 15. From January to April, 72 large and medium-sized production enterprises had a net loss of 5.18 billion yuan, including a net loss of 1.5 billion yuan in April and a loss of nearly 40%. The non-ferrous metals industry initially got rid of the loss. From January to April, the output of ten non-ferrous metals was 7.33 million tons, down 6.5% year-on-year; among them, the output of electrolytic copper was 1.27 million tons, up 6.7%; the output of electrolytic aluminum was 3.54 million tons, down 15.2%. Under the influence of the country's policy of expanding domestic demand and implementing industrial restructuring and revitalization, the prices of major non-ferrous metals fluctuated and the industry's efficiency improved. At the end of April, the average spot price of copper and zinc in the domestic market rebounded to 37,675 and 12,587 yuan/ton respectively, and the average spot price of electrolytic aluminum rebounded to 13,165 yuan/ton, leaving a profitable space for enterprises to reverse their profits. From January to April, 71 households with key enterprises had a net loss of 490 million yuan, of which profit was 1.73 billion yuan and 1.65 billion yuan in March and April respectively. Copper enterprises have turned losses into profits, and other metal varieties have also shown a deficit reduction trend.

The non-ferrous metals industry initially got rid of the loss. From January to April, the output of ten non-ferrous metals was 7.33 million tons, down 6.5% year-on-year; among them, the output of electrolytic copper was 1.27 million tons, up 6.7%; the output of electrolytic aluminum was 3.54 million tons, down 15.2%. Under the influence of the country's policy of expanding domestic demand and implementing industrial restructuring and revitalization, the prices of major non-ferrous metals fluctuated and the industry's efficiency improved. At the end of April, the average spot price of copper and zinc in the domestic market rebounded to 37,675 and 12,587 yuan/ton respectively, and the average spot price of electrolytic aluminum rebounded to 13,165 yuan/ton, leaving a profitable space for enterprises to reverse their profits. From January to April, 71 households with key enterprises had a net loss of 490 million yuan, of which profit was 1.73 billion yuan and 1.65 billion yuan in March and April respectively. Copper enterprises have turned losses into profits, and other metal varieties have also shown a deficit reduction trend.  The building materials industry has shown good growth momentum. Driven by infrastructure construction, cement production has maintained rapid growth this year. From January to April, the national cement output was 428.91 million tons, a year-on-year increase of 13%, and the growth rate accelerated by 3.1 percentage points year-on-year. Flat glass production is relatively low. From January to April, flat glass production was 181.8 million weight boxes, up only 0.9% year-on-year; but as the real estate market began to pick up, production in April increased by 3.1%, 2.6 percentage points faster than the first quarter. In the first four months, cement prices were still in the downside range, but higher than the same period last year; flat glass prices have been falling for 7 months, and have risen in 3 and 4 months. At the end of April, the cement stock of key building materials enterprises was 11.5 million tons, up 6.7% year-on-year; the inventory of flat glass was 19.33 million weight boxes, down 25.4%.

The building materials industry has shown good growth momentum. Driven by infrastructure construction, cement production has maintained rapid growth this year. From January to April, the national cement output was 428.91 million tons, a year-on-year increase of 13%, and the growth rate accelerated by 3.1 percentage points year-on-year. Flat glass production is relatively low. From January to April, flat glass production was 181.8 million weight boxes, up only 0.9% year-on-year; but as the real estate market began to pick up, production in April increased by 3.1%, 2.6 percentage points faster than the first quarter. In the first four months, cement prices were still in the downside range, but higher than the same period last year; flat glass prices have been falling for 7 months, and have risen in 3 and 4 months. At the end of April, the cement stock of key building materials enterprises was 11.5 million tons, up 6.7% year-on-year; the inventory of flat glass was 19.33 million weight boxes, down 25.4%.  The chemical industry is showing signs of stabilization and recovery. In April, the added value of the chemical industry increased by 10.6% year-on-year, and has maintained a growth rate of more than 10% for two consecutive months. Among the 30 major chemical products under key monitoring, more than 70% of the products have a faster growth rate than the first quarter (including Some products have slowed down.) In April, most chemical product prices continued their upward trend in the first two months. According to the statistics of the China Logistics Purchasing Association, the price of major chemical products in the month rose by 7.3% from the previous month. The prices of 42 major chemical products monitored by China Chemical Network were 25 higher than those at the end of March, 9 were unchanged from the end of last month, and only 8 were down. The quarterly reports of 33 chemical listed companies in Shenzhen and Shanghai showed that the net profit in the first quarter was 680 million yuan, although the year-on-year decline was 19.5%, but the chain growth was 1.12 times.

The chemical industry is showing signs of stabilization and recovery. In April, the added value of the chemical industry increased by 10.6% year-on-year, and has maintained a growth rate of more than 10% for two consecutive months. Among the 30 major chemical products under key monitoring, more than 70% of the products have a faster growth rate than the first quarter (including Some products have slowed down.) In April, most chemical product prices continued their upward trend in the first two months. According to the statistics of the China Logistics Purchasing Association, the price of major chemical products in the month rose by 7.3% from the previous month. The prices of 42 major chemical products monitored by China Chemical Network were 25 higher than those at the end of March, 9 were unchanged from the end of last month, and only 8 were down. The quarterly reports of 33 chemical listed companies in Shenzhen and Shanghai showed that the net profit in the first quarter was 680 million yuan, although the year-on-year decline was 19.5%, but the chain growth was 1.12 times.

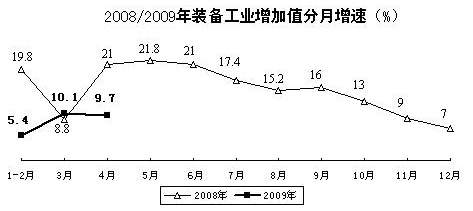

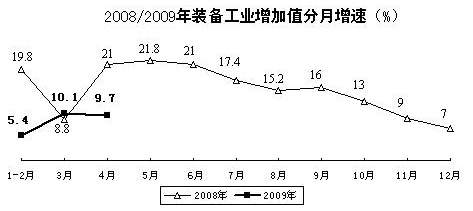

2. The equipment industry is driven by favorable policies and market demand, and the equipment industry is showing a recovery growth trend. From January to April, the added value of the equipment industry increased by 7.3% year-on-year; in March and April, it increased by 10.1% and 9.7% respectively, both faster than the last two months of last year and January-February this year, and higher than the overall industrial growth rate. The equipment industry accounted for 18.7% of the total industrial added value. The growth of automobile production and sales is strong. According to the statistics of China Association of Automobile Manufacturers, from January to April, the company produced 3.723 million vehicles and sold 3.382 million vehicles, up 6.4% and 9.4% respectively year-on-year; of which, 1.157 million were produced in April, and 1.153 million units were sold, up 17.9% respectively. And 25%, production and sales have remained at more than 1 million vehicles for two consecutive months. Thanks to the halving of the purchase price of passenger cars of 1.6 liters and below, from January to April, sales of 2.06 million passenger cars of 1.6 liters and below were increased by 30.4% year-on-year. The mid-to-high-displacement sedan showed signs of recovery. In April, the sales volume of 1.6-liter to 2-liter (inclusive) and 2-liter to 2.5-liter cars increased by 2.2% and 5.2% respectively from March. The improvement in production and sales brought about an increase in industry benefits. In the first quarter, 19 key automobile manufacturers (operating income accounted for about 50% of the whole industry) realized a profit of 10.8 billion yuan, a year-on-year decrease of 48.8%, a decrease of 11% over the previous two months. Percentage points.

The growth of automobile production and sales is strong. According to the statistics of China Association of Automobile Manufacturers, from January to April, the company produced 3.723 million vehicles and sold 3.382 million vehicles, up 6.4% and 9.4% respectively year-on-year; of which, 1.157 million were produced in April, and 1.153 million units were sold, up 17.9% respectively. And 25%, production and sales have remained at more than 1 million vehicles for two consecutive months. Thanks to the halving of the purchase price of passenger cars of 1.6 liters and below, from January to April, sales of 2.06 million passenger cars of 1.6 liters and below were increased by 30.4% year-on-year. The mid-to-high-displacement sedan showed signs of recovery. In April, the sales volume of 1.6-liter to 2-liter (inclusive) and 2-liter to 2.5-liter cars increased by 2.2% and 5.2% respectively from March. The improvement in production and sales brought about an increase in industry benefits. In the first quarter, 19 key automobile manufacturers (operating income accounted for about 50% of the whole industry) realized a profit of 10.8 billion yuan, a year-on-year decrease of 48.8%, a decrease of 11% over the previous two months. Percentage points.

The process of agricultural machinery going to the countryside has accelerated. According to the statistics of the Ministry of Agriculture, as of April 30, the central government has issued 10 billion yuan of subsidies for the purchase of agricultural machinery. In fact, 1.2 million households have been subsidized, 6.16 billion yuan have been funded, and 1.32 million sets of agricultural machinery have been subsidized. Driven by market demand, in January-April, the production of large and medium-sized tractors increased by 50% and 33.2%, respectively, and crop harvesting machinery and on-the-spot machinery increased by 33% and 25.8% respectively.

Special equipment is accelerated by investment. From January to April, investment in chemical raw materials and products, printing and railway transportation increased by 34.1%, 19.8% and 94.2% respectively in the national fixed assets investment. Driven by the substantial increase in investment, the output of special equipment for refining and chemical production increased by 25.6% year-on-year, the output of printing special equipment increased by 21.9%, and the output of railway passenger cars increased by 1.68 times.

The production and sales situation of construction machinery improved. Since the beginning of March, with the large-scale construction of various domestic engineering projects, the demand for construction machinery has rebounded significantly, and the domestic sales situation is better than exports. In the first quarter, it sold a total of 24,027 excavators and 31,375 loaders, of which 13,314 units and 16,792 units were sold in March, accounting for more than half of the sales in the first quarter; cumulative sales of bulldozers and cranes exceeded 2,000 and 7,000 units respectively, including March. It sold more than 800 sets and more than 3,000 sets respectively. In April, the average daily output of cranes increased by 4.1% compared with March, and the increase of loaders, conveyors, excavators and compaction machinery was 12.6%-50.6%.

The machine tool industry is in an adjustment period. From January to April, the output of metal cutting machine tools and metal forming machine tools decreased by 20.5% and 20.2% respectively. Among them, CNC metal cutting machine tools and CNC metal forming machine tools decreased by 18.7% and 8.3% respectively. The overall machine tool industry is still in decline. Many enterprises have reflected that the effects of policies and measures such as the expansion of domestic demand and the implementation of key industries adjustment and revitalization plans are being transmitted to the machine tool industry through the upstream industry. Machine tool orders have rebounded in the past two months, and demand for high-end CNC machine tools has increased, but small and medium-sized ordinary machine tools The market situation is still not optimistic. From the production situation in April, although the output of metal cutting machine tools and forming machine tools decreased by 21% and 34%, the daily output of the month increased by 5.1% and 17.7% respectively compared with March.

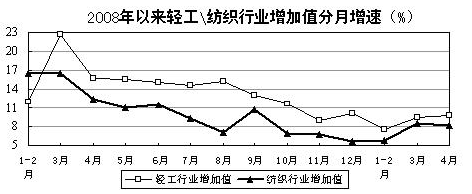

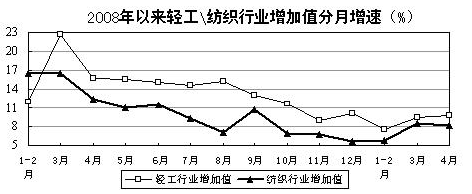

3. The steady growth of the domestic market of the consumer goods industry has partly compensated for the impact of insufficient external demand and the decline of exports. The operation of the consumer goods industry is relatively stable, which has played a positive role in promoting the steady recovery of industry. From January to April, the added value of the consumer goods industry increased by 8% year-on-year, with a growth of 9.8% and 9.2% in three and four months. Among the major industries, the light industry, textile, tobacco and pharmaceutical industries increased by 8.1%, 6.6%, 6.1% and 13.8% respectively. The added value of the four industries accounted for 18.7%, 6.3%, 3% and 2.4 respectively of the total industrial added value. %, a total of 30.4%.

The light industry and textile industry are running smoothly. Under the unfavorable situation that the international market is shrinking and exports are blocked, the light industry and textile industry are based on the domestic market, and the overall operation has maintained a good momentum of steady recovery. In April, the added value of the light industry increased by 9.8% year-on-year, 0.4 percentage points higher than that in March. The growth rate of agricultural and sideline food processing, food manufacturing and beverage manufacturing reached 13.2%-19.2%. In the three months and four months, the growth rate of the textile industry exceeded 8%, which was higher than the monthly level in the fourth quarter of last year, in which clothing and footwear manufacturing reached a growth rate of 10%.

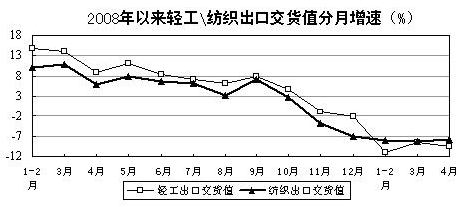

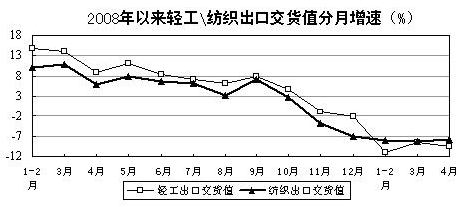

The decline in the decline in exports of textile products has slowed down. From January to April, the export delivery value of light industry and textile industry decreased by 10.9% and 8.4% respectively year-on-year, which was less than the overall industrial export decline of 4.8 and 7.4 percentage points respectively. Judging from the changes in the monthly export delivery value growth rate, the trend of the slowdown in the export of textile products in March and April has been initially contained.

The decline in the decline in exports of textile products has slowed down. From January to April, the export delivery value of light industry and textile industry decreased by 10.9% and 8.4% respectively year-on-year, which was less than the overall industrial export decline of 4.8 and 7.4 percentage points respectively. Judging from the changes in the monthly export delivery value growth rate, the trend of the slowdown in the export of textile products in March and April has been initially contained.  The effects of expanding consumer policies such as “home appliances going to the countryside†are gradually emerging. From January to April, among the 14 major household electrical appliances that were mainly counted, there were 8 kinds of growth, of which refrigerators and rice cookers increased by 7% and 8.1% respectively, and water dispensers and gas cookers increased by 22% and 20.3% respectively. In order to speed up the promotion of home appliances to the countryside, on April 16, the Ministry of Finance, the Ministry of Commerce, the Ministry of Industry and Information Technology and other departments jointly issued the "Detailed Implementation Rules for Home Appliances to the Countryside" to further simplify the subsidy payment procedures. In April, the average daily output of 14 major household electrical appliances increased by 10 compared with that of March, of which 8 were growth rates exceeding 10%. According to the statistics of the Ministry of Commerce, from January to April, the total sales of home appliances in the countryside was 4.46 million units, and the sales amount reached 6.8 billion yuan.

The effects of expanding consumer policies such as “home appliances going to the countryside†are gradually emerging. From January to April, among the 14 major household electrical appliances that were mainly counted, there were 8 kinds of growth, of which refrigerators and rice cookers increased by 7% and 8.1% respectively, and water dispensers and gas cookers increased by 22% and 20.3% respectively. In order to speed up the promotion of home appliances to the countryside, on April 16, the Ministry of Finance, the Ministry of Commerce, the Ministry of Industry and Information Technology and other departments jointly issued the "Detailed Implementation Rules for Home Appliances to the Countryside" to further simplify the subsidy payment procedures. In April, the average daily output of 14 major household electrical appliances increased by 10 compared with that of March, of which 8 were growth rates exceeding 10%. According to the statistics of the Ministry of Commerce, from January to April, the total sales of home appliances in the countryside was 4.46 million units, and the sales amount reached 6.8 billion yuan.

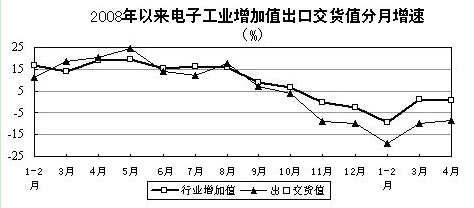

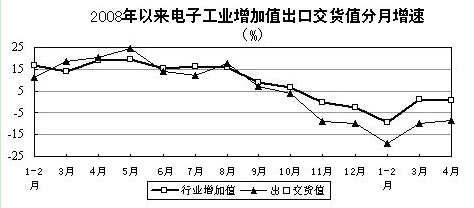

4. The electronics manufacturing industry is highly extroverted (the export value of the first four months accounted for 64.2% of the industry's sales value), and the electronics manufacturing industry is one of the industries most affected by the international financial crisis. . From January to April, the added value of the electronics manufacturing industry fell by 3.7% year-on-year. From March to April, it increased by 1.2% and 1.1% respectively, but the prospect of recovery is still unclear.

The decline in exports has not changed fundamentally. According to customs statistics, in January-April, the export of electronic information products was 120.7 billion US dollars, down 24.1% year-on-year; of which, it fell by 22.9% in April, a decrease of 0.8 percentage points over March. The domestic market is growing better. From January to April, the domestic sales value of electronic information manufacturing enterprises above designated size increased by 5.1%, of which 11.4% in April, up 0.9 percentage points from the previous month. Driven by 3G investment in the telecommunications industry, domestic sales of communications equipment manufacturing grew by 9.5% in April, with the exchange equipment industry growing by 79%. However, the growth of the domestic market has a limited effect on reversing the decline of the industry.

The domestic market is growing better. From January to April, the domestic sales value of electronic information manufacturing enterprises above designated size increased by 5.1%, of which 11.4% in April, up 0.9 percentage points from the previous month. Driven by 3G investment in the telecommunications industry, domestic sales of communications equipment manufacturing grew by 9.5% in April, with the exchange equipment industry growing by 79%. However, the growth of the domestic market has a limited effect on reversing the decline of the industry.

Most production is still falling. In April, there were 37 kinds of 55 kinds of products monitored by the key year-on-year decline, accounting for 67.3% of the total; 33 kinds of growth rate decreased or decreased by 60%, which accounted for 60% of the total. In the same month, the output of mobile phones and microcomputer equipment decreased from 1.2% and 15.4% in the previous month to 9.3% and 5% respectively. The output of digital program-controlled switches decreased from 20.5% in the previous month to 9.7%.

5. Energy supply and demand from January to April, the country's total primary energy production totaled 78.443 million tons, an increase of 6.6%, of which 7.3% in April.

Coal and electricity supply and demand are more relaxed. From January to April, the country's raw coal output was 827.80 million tons, an increase of 6.8% year-on-year, of which 7.9% in April. Coal exports were 9.34 million tons, down 36%; imports were 22.75 million tons, up 55.7%. Due to the decline in demand for major coal-using industries such as electricity and steel, some large mines have adopted measures to limit production. In April, coal prices rebounded slightly and port coal storage decreased. At the end of April, Qinhuangdao Port stored 3.7 million tons of coal, down 1.6 million tons from the end of last month; Qinhuangdao Port's reference price of 5,500 kcal/ton of Shanxi excellent blended coal was 570-585 yuan/ton, up from the end of last month. 20-25 yuan / ton.

From January to April, the cumulative average utilization hours of power generation equipment in the country was 1354 hours, a decrease of 202 hours compared with the same period of last year. Among them, the average utilization hours of thermal power equipment was 1468 hours, a decrease of 238 hours compared with the same period of last year; the average utilization hours of hydropower equipment was 854 hours, an increase of 18 hours.

The oil supply is basically stable. From January to April, the national crude oil output was 61.75 million tons, down 0.9% year-on-year; the crude oil import volume was 57.07 million tons, up 4.5%; the crude oil processing volume was 111.72 million tons, down 1.8%, of which gasoline and diesel production increased by 10.1% and 1.9 respectively. %. The international oil price oscillated upward. In April, the monthly average price of Brent crude oil was 50.42 US dollars / barrel, up 6 US dollars / barrel from last month, up 10 US dollars / barrel from the end of last year. At the end of March, the country raised the price of domestic refined oil. Second, the main problems affecting the current industrial operation In the first four months, there have been some positive changes in China's industrial operation, but the overall situation is still grim, and there are still many uncertain factors affecting industrial operation, and the basis for recovery is still not solid.

Second, the main problems affecting the current industrial operation In the first four months, there have been some positive changes in China's industrial operation, but the overall situation is still grim, and there are still many uncertain factors affecting industrial operation, and the basis for recovery is still not solid.

1. The international financial crisis has spread and the external demand has continued to shrink. After the international financial crisis, governments adopted a series of economic revitalization measures and achieved certain results. However, these measures are difficult to get the economy out of recession in the short term. On March 13, the International Monetary Fund once again lowered its global economic growth forecast for this year, which is expected to fall by 0.5%-1.5%, which is 2.2 percentage points lower than the forecast for November last year. On March 23, the WTO predicted that world trade volume will drop by 9% this year. Under the background of economic globalization, China's economy is difficult to protect itself. The lack of external demand, especially the shrinking of developed countries' markets, will still be the biggest difficulty facing China's industrial exports in the future, and the industrial downside risks will increase.

2. In some industries, overcapacity is serious and it is difficult to solve in the short term. In recent years, blind investment in some industries and regions, and low-level redundant construction problems have become prominent, resulting in overcapacity. This problem has become more prominent in the case of a sharp decline in external demand. At the end of 2008, China's steel production capacity has reached 660 million tons per year, accounting for nearly half of the world's steel production capacity. It is estimated that the balance of supply and demand this year will be less than 500 million tons, and the overcapacity will exceed 100 million tons. At the end of April, the total inventory of five types of steel in 26 large and medium-sized cities nationwide reached 9.47 million tons, an increase of 17.3%. The production capacity of electrolytic aluminum is about 40%. Solving the problem of overcapacity involves both the enterprise level and the social level. The mechanism of staff placement, debt processing, and enterprise transformation is still not perfect, so it will be a long-term and complicated process.

3. The business environment needs further improvement. To reverse the current decline in industrial growth, enterprises are the key. At present, the problem of enterprise financing difficulties has not been effectively solved. Under the circumstances that the credit scale has increased substantially, the credit line of SMEs is generally small. The state's policy of reducing the business burden of enterprises has not yet been put in place in some places. Some enterprises have reported that the tax burden is still heavy, and the problem of unreasonable apportionment and arbitrary charges still exists.

4. The decline in profits has led to insufficient investment capacity. In the first quarter, industrial profits continued to decline sharply, with corporate losses reaching one-quarter, and 21 of the 39 industrial sectors were worse than the previous two months. The decline in operating efficiency not only affects the ability of enterprises to invest and finance, but also affects the inflow of social capital into the industrial sector.

III. Recent Industrial Economic Trends and Suggestions for Policy Measures In the second quarter, the industrial economy will continue to maintain a positive trend towards good performance this year. It is expected that the industrial growth rate may reach around 8%. In the second half of the year, with the gradual implementation of various measures to expand domestic demand and maintain growth, the industrial growth rate will further rise and reach a growth level of more than 10%.

In order to achieve the smooth operation of the industrial economy and complete the tasks of the year, it is recommended to pay attention to the following aspects:

1. We insist on expanding domestic demand as the main way to reverse the decline in growth rate. Reversing the decline in industrial growth as soon as possible is the primary goal of the current industrial economy. It is necessary to give full play to domestic demand, especially the leading role of consumer demand in stabilizing industry, and further improve and implement policies and measures to expand domestic demand and stimulate consumption. Continue to implement the policy of home appliances going to the countryside, agricultural machinery to the countryside, and automobile (motorcycle) to the countryside, and strive to solve outstanding problems such as inadequate after-sales service in the process of “three rural areas†and guide enterprises to develop products suitable for the needs of the rural market. Study and promote relevant policies and measures for other industrial products going to the countryside to further develop the rural market. It is necessary to create a more relaxed policy environment for accelerating the initiation of private investment, and form a benign interaction between government investment and private investment follow-up. Actively promote the stable and healthy development of the real estate market, and give full play to the role of the real estate market in driving the economy.

2. Adhere to the adjustment structure as an important means of achieving sustainable development. It is necessary to correctly handle the relationship between maintaining growth and adjusting structure, conscientiously implementing the adjustment and revitalization plan for key industries, vigorously promoting technological transformation of enterprises, accelerating the transformation of industrial development methods, and constantly forming new growth points. Taking technological transformation as the starting point and industrial upgrading as the goal, we will accelerate the advancement of advanced and applicable technologies to transform traditional industries. Vigorously promote cross-regional and cross-industry mergers and acquisitions, and support superior enterprises to acquire backward enterprises and difficult enterprises. Establish and improve the exit mechanism for eliminating backward production capacity, strictly control low-level redundant construction, and prevent the resurgence of backward production capacity. Support the development of industrial services such as R&D, technology consulting, modern logistics, financing and credit, and promote the development of new industries such as new energy and new materials.

3. Adhere to the promotion of reform as an institutional guarantee to improve the development environment. At present, the problems and difficulties in China's economic operation are not only the impact of the international financial crisis, but also the long-term accumulation of institutional and structural obstacles that restrict the steady and rapid development of the economy. It is necessary to accelerate the reform of key areas, focus on solving institutional obstacles in industrial development, and further improve the ability to cope with the international financial crisis. It is necessary to take the outstanding problems reflected by the current enterprises as the entry point for reform, establish a level playing field, and support the non-public economy and SMEs to accelerate development. It is necessary to further innovate the financing model of enterprises and solve the problem of financing difficulties for SMEs by setting up microfinance companies. It is necessary to further improve the standardized tax collection and supervision mechanism and effectively reduce the burden on enterprises.

4. Persist in stabilizing exports as an important measure to promote industrial growth. Give full play to the comparative advantages of China's export products, continue to improve the export promotion policies of seller credit, buyer credit and external guarantees, further increase support for import and export, stabilize and expand China's mechanical and electrical products and labor-intensive textile products export market . Encourage qualified enterprises to “go out†and drive the export of related products through contracted projects and infrastructure construction.

For 30 years, industry has been the forefront of China's reform and opening up, and it is also the industry with the fastest improvement in international competitiveness. The development of industry is decisive for strengthening national strength and improving people's livelihood. Realizing industrial revitalization is extremely important for getting rid of the impact of international financial crisis as soon as possible. Significance. China's industry has the strength and ability to withstand the impact of the international financial crisis. In the industries most affected by the crisis and the most obvious decline, a group of dominant enterprises are rising against the trend and will continue to be trained and tested in this financial crisis. The overall competitiveness of the industry will be further enhanced.

At the same time, the situation facing the operation of the industrial economy is still complicated and grim. From the perspective of the internal and external environment of economic operation, this year will be the most difficult year for China's industry to enter the new century. Although there have been some positive changes in the economic operation, the foundation is still not solid, and the industry is “guaranteeing growth, adjusting structure and The level of the task is very difficult.

I. Basic Situation of Industrial Economic Operation in the First Four Months (I) The momentum of sharp decline in industrial growth rate was initially contained, and the overall operation was shifting towards a positive direction.

From January to April, the added value of industrial enterprises above designated size increased by 5.5% year-on-year, of which 5.1% in the first quarter was the lowest growth rate in the past 15 years. From the monthly operating situation, the first two months increased by 3.8%, the lowest point since the second half of last year; the growth rate in March and April respectively rose back to 8.3% and 7.3%, both higher than last November and December growth. Level. The operation in the first four months shows that the central government's series of policies and measures to expand domestic demand and maintain growth have achieved initial results, and the industrial economy has shown positive changes.

1. Light industry operations are basically stable, and heavy industry has risen from down. From January to April, the added value of light and heavy industries increased by 7% and 4.9% respectively. The growth rate of light and heavy industries experienced a continuous decline since the second half of last year. It fell to a low of 6.5% and 2.7% in the first two months of this year, and then a different degree of recovery. In 3 and 4 months, the growth rate of light industry rebounded to 8.5% and 8.2%, and heavy industry rebounded to 8.3% and 6.9%. From the overall operational situation, the light industry is mainly driven by the rigid consumption demand, the degree of decline is shallow, and the production situation is relatively stable. After heavy industry has undergone more than half a year of adjustment, the raw materials purchased at high prices in the early period have been basically digested, and the product inventory has basically returned to normal levels. In addition, the purchase price of raw materials, fuels and power has decreased, and the operating conditions have improved.

1. Light industry operations are basically stable, and heavy industry has risen from down. From January to April, the added value of light and heavy industries increased by 7% and 4.9% respectively. The growth rate of light and heavy industries experienced a continuous decline since the second half of last year. It fell to a low of 6.5% and 2.7% in the first two months of this year, and then a different degree of recovery. In 3 and 4 months, the growth rate of light industry rebounded to 8.5% and 8.2%, and heavy industry rebounded to 8.3% and 6.9%. From the overall operational situation, the light industry is mainly driven by the rigid consumption demand, the degree of decline is shallow, and the production situation is relatively stable. After heavy industry has undergone more than half a year of adjustment, the raw materials purchased at high prices in the early period have been basically digested, and the product inventory has basically returned to normal levels. In addition, the purchase price of raw materials, fuels and power has decreased, and the operating conditions have improved.  2. The decline in the benefits has improved, and the “two funds†occupancy rate has declined. In the first quarter, the province's 22 provinces with statistical industrial benefits achieved a total profit of 322.7 billion yuan, a year-on-year decrease of 32.2%, a decrease of 7.3 percentage points over the previous two months. At the end of March, the funds occupied by industrial accounts receivable and finished goods inventory in 22 provinces increased by 7% and 10.4% respectively, which was 0.4 and 3.6 percentage points lower than the previous two months. The improvement of the efficiency situation will further alleviate the pressure on the production and operation of enterprises.

2. The decline in the benefits has improved, and the “two funds†occupancy rate has declined. In the first quarter, the province's 22 provinces with statistical industrial benefits achieved a total profit of 322.7 billion yuan, a year-on-year decrease of 32.2%, a decrease of 7.3 percentage points over the previous two months. At the end of March, the funds occupied by industrial accounts receivable and finished goods inventory in 22 provinces increased by 7% and 10.4% respectively, which was 0.4 and 3.6 percentage points lower than the previous two months. The improvement of the efficiency situation will further alleviate the pressure on the production and operation of enterprises. 3. Production recovery in most provinces accelerated, and the recovery in the eastern region was obvious. In April, the industrial growth rate of 21 provinces in the country increased or decreased in different degrees from the first quarter. Among the major industrial provinces, Shandong, Jiangsu and Guangdong provinces, which accounted for 14%, 12.2% and 10.5% of the national industrial added value, grew at a rate of 14.1%, 14.4% and 3.5% respectively, up 7.6 and 3.8 from the first quarter. 2.6 percentage points; Zhejiang Province's monthly added value, which accounted for 5.6% of the national industrial added value, changed from a 5.6% decline in the first quarter to a 0.2% increase; the monthly growth rate of Henan and Liaoning provinces, which accounted for 5.4% and 5.3% of the national industrial added value. They were 7.3% and 12% respectively, up 4.2 and 0.8 percentage points from the first quarter. In the same month, the industrial added value of the eastern, central and western regions increased by 6.7%, 5.5% and 12.7% respectively, which was 3, 0.3 and 0.9 percentage points higher than the first quarter. Relatively speaking, the impact of the international financial crisis on the industrial development in the eastern part of China is earlier and to a greater extent. The industrial base in the eastern region is good and the scale is large. The rapid recovery of its production situation will lay a foundation for the steady recovery of the national industrial growth rate. Good foundation.

4. The policy role of adjusting the export tax rebate rate appears. According to customs statistics, from January to April, China’s foreign trade exports were US$337.4 billion, down 20.5% year-on-year; of which exports were US$91.9 billion in April, down 22.6%, a decrease of 5.4 percentage points from March, based on the average working day, and exported in the same month. It is 6.8% higher than in March. Since the second half of last year, the country’s exports of export tax rebates have been increased by 48.7 billion U.S. dollars in April, down 18.6% year-on-year, which is lower than the overall national export decline of 4 percentage points. The export value accounted for 52.8% of the national export value of the month; On average, the working day, the export of the month increased by 9.4% compared with March. Among the major exporting provinces, Guangdong, Zhejiang, Shandong, Fujian, and Beijing (the export accounted for 57% of the national total) fell by 12.9%-20.3% in the month, which was less than the national average.

5. Industrial investment grew steadily, and technological transformation of enterprises progressed steadily. From January to April, the national urban fixed asset investment increased by 30.5% year-on-year, of which the investment in industry was 1,569.8 billion yuan, an increase of 27.7%, accounting for 42.3% of the national urban fixed assets investment. In fixed asset investment, construction and installation engineering investment and equipment and equipment purchase costs increased by 33.1% and 31.1% respectively. This year, the central government's 20 billion yuan technical transformation special fund project declaration and approval work has been steadily advanced, more than 70% of the plan has been issued, and the total investment of the project exceeds 200 billion yuan. Since the beginning of this year, the strong growth of fixed asset investment has not only formed a strong pulling effect on the raw material industry and equipment manufacturing industry, but also the rapid growth of industrial direct investment will further enhance the stamina of industrial development.

5. Industrial investment grew steadily, and technological transformation of enterprises progressed steadily. From January to April, the national urban fixed asset investment increased by 30.5% year-on-year, of which the investment in industry was 1,569.8 billion yuan, an increase of 27.7%, accounting for 42.3% of the national urban fixed assets investment. In fixed asset investment, construction and installation engineering investment and equipment and equipment purchase costs increased by 33.1% and 31.1% respectively. This year, the central government's 20 billion yuan technical transformation special fund project declaration and approval work has been steadily advanced, more than 70% of the plan has been issued, and the total investment of the project exceeds 200 billion yuan. Since the beginning of this year, the strong growth of fixed asset investment has not only formed a strong pulling effect on the raw material industry and equipment manufacturing industry, but also the rapid growth of industrial direct investment will further enhance the stamina of industrial development.  6. The comprehensive energy consumption level has decreased, and the energy efficiency of key energy-consuming enterprises has increased. In the first quarter, the comprehensive energy consumption of industrial enterprises above designated size was 489 million tons, down 6.2% year-on-year, accounting for 74% of the total national energy consumption. Among the 39 industrial categories, 29 were reduced in comprehensive energy consumption, of which 10% fell. There are 9 above; the energy consumption of industrial units has decreased by 10.8% year-on-year. Energy consumption indicators of key energy-consuming enterprises continue to decrease, and energy utilization efficiency is improved. According to the statistics on energy consumption of industrial enterprises with an annual comprehensive energy consumption of 10,000 tons of standard coal and above, in the 53 products or processes, there were 41 kinds of comprehensive energy consumption decreased in the first quarter, and 12 of them increased, accounting for 77% respectively. And 23%; the energy used for energy recovery reaches 19.35 million tons of standard coal, and the recovery utilization rate is 2.25%.

6. The comprehensive energy consumption level has decreased, and the energy efficiency of key energy-consuming enterprises has increased. In the first quarter, the comprehensive energy consumption of industrial enterprises above designated size was 489 million tons, down 6.2% year-on-year, accounting for 74% of the total national energy consumption. Among the 39 industrial categories, 29 were reduced in comprehensive energy consumption, of which 10% fell. There are 9 above; the energy consumption of industrial units has decreased by 10.8% year-on-year. Energy consumption indicators of key energy-consuming enterprises continue to decrease, and energy utilization efficiency is improved. According to the statistics on energy consumption of industrial enterprises with an annual comprehensive energy consumption of 10,000 tons of standard coal and above, in the 53 products or processes, there were 41 kinds of comprehensive energy consumption decreased in the first quarter, and 12 of them increased, accounting for 77% respectively. And 23%; the energy used for energy recovery reaches 19.35 million tons of standard coal, and the recovery utilization rate is 2.25%. (2) The policy effect of expanding domestic demand has gradually emerged, and some industries have stabilized and rebounded during the adjustment.

1. In the first four months of the raw material industry, the added value of the raw materials industry increased by 5.3% year-on-year, with an increase of 7% in April. In the major industries, the metallurgical, non-ferrous, building materials and chemical industries increased by 1%, 4%, 12.8% and 6.1% respectively. The added value of the four industries accounted for 10%, 3.4%, 5.2% and 6.9% of the total industrial added value respectively. , a total of 25.5%.

The steel industry as a whole is in a shock adjustment. In the first quarter, global crude steel output fell by 22.8% year-on-year. Under the policy of expanding domestic demand, the market supply and demand situation improved. The crude steel output in the first four months was 174.67 million tons, which was basically the same as the same period of last year. The output was maintained at 1.45 million tons / day. Long products grew faster and the plates were relatively weak. Affected by the sharp drop in international market prices and oversupply in the domestic market, steel prices are generally at a low level, and the entire industry is at a loss. According to the statistics of the China Iron and Steel Association, at the end of April, the comprehensive price index of steel products in the domestic market was 95.56, lower than the lowest point in November last year. Recently, with the decline in inventories and the increase in demand, the domestic steel market price has also gone out for 10 consecutive weeks. It has been on the rise for five consecutive weeks until May 15. From January to April, 72 large and medium-sized production enterprises had a net loss of 5.18 billion yuan, including a net loss of 1.5 billion yuan in April and a loss of nearly 40%.

The non-ferrous metals industry initially got rid of the loss. From January to April, the output of ten non-ferrous metals was 7.33 million tons, down 6.5% year-on-year; among them, the output of electrolytic copper was 1.27 million tons, up 6.7%; the output of electrolytic aluminum was 3.54 million tons, down 15.2%. Under the influence of the country's policy of expanding domestic demand and implementing industrial restructuring and revitalization, the prices of major non-ferrous metals fluctuated and the industry's efficiency improved. At the end of April, the average spot price of copper and zinc in the domestic market rebounded to 37,675 and 12,587 yuan/ton respectively, and the average spot price of electrolytic aluminum rebounded to 13,165 yuan/ton, leaving a profitable space for enterprises to reverse their profits. From January to April, 71 households with key enterprises had a net loss of 490 million yuan, of which profit was 1.73 billion yuan and 1.65 billion yuan in March and April respectively. Copper enterprises have turned losses into profits, and other metal varieties have also shown a deficit reduction trend.

The non-ferrous metals industry initially got rid of the loss. From January to April, the output of ten non-ferrous metals was 7.33 million tons, down 6.5% year-on-year; among them, the output of electrolytic copper was 1.27 million tons, up 6.7%; the output of electrolytic aluminum was 3.54 million tons, down 15.2%. Under the influence of the country's policy of expanding domestic demand and implementing industrial restructuring and revitalization, the prices of major non-ferrous metals fluctuated and the industry's efficiency improved. At the end of April, the average spot price of copper and zinc in the domestic market rebounded to 37,675 and 12,587 yuan/ton respectively, and the average spot price of electrolytic aluminum rebounded to 13,165 yuan/ton, leaving a profitable space for enterprises to reverse their profits. From January to April, 71 households with key enterprises had a net loss of 490 million yuan, of which profit was 1.73 billion yuan and 1.65 billion yuan in March and April respectively. Copper enterprises have turned losses into profits, and other metal varieties have also shown a deficit reduction trend.  The building materials industry has shown good growth momentum. Driven by infrastructure construction, cement production has maintained rapid growth this year. From January to April, the national cement output was 428.91 million tons, a year-on-year increase of 13%, and the growth rate accelerated by 3.1 percentage points year-on-year. Flat glass production is relatively low. From January to April, flat glass production was 181.8 million weight boxes, up only 0.9% year-on-year; but as the real estate market began to pick up, production in April increased by 3.1%, 2.6 percentage points faster than the first quarter. In the first four months, cement prices were still in the downside range, but higher than the same period last year; flat glass prices have been falling for 7 months, and have risen in 3 and 4 months. At the end of April, the cement stock of key building materials enterprises was 11.5 million tons, up 6.7% year-on-year; the inventory of flat glass was 19.33 million weight boxes, down 25.4%.

The building materials industry has shown good growth momentum. Driven by infrastructure construction, cement production has maintained rapid growth this year. From January to April, the national cement output was 428.91 million tons, a year-on-year increase of 13%, and the growth rate accelerated by 3.1 percentage points year-on-year. Flat glass production is relatively low. From January to April, flat glass production was 181.8 million weight boxes, up only 0.9% year-on-year; but as the real estate market began to pick up, production in April increased by 3.1%, 2.6 percentage points faster than the first quarter. In the first four months, cement prices were still in the downside range, but higher than the same period last year; flat glass prices have been falling for 7 months, and have risen in 3 and 4 months. At the end of April, the cement stock of key building materials enterprises was 11.5 million tons, up 6.7% year-on-year; the inventory of flat glass was 19.33 million weight boxes, down 25.4%.  The chemical industry is showing signs of stabilization and recovery. In April, the added value of the chemical industry increased by 10.6% year-on-year, and has maintained a growth rate of more than 10% for two consecutive months. Among the 30 major chemical products under key monitoring, more than 70% of the products have a faster growth rate than the first quarter (including Some products have slowed down.) In April, most chemical product prices continued their upward trend in the first two months. According to the statistics of the China Logistics Purchasing Association, the price of major chemical products in the month rose by 7.3% from the previous month. The prices of 42 major chemical products monitored by China Chemical Network were 25 higher than those at the end of March, 9 were unchanged from the end of last month, and only 8 were down. The quarterly reports of 33 chemical listed companies in Shenzhen and Shanghai showed that the net profit in the first quarter was 680 million yuan, although the year-on-year decline was 19.5%, but the chain growth was 1.12 times.

The chemical industry is showing signs of stabilization and recovery. In April, the added value of the chemical industry increased by 10.6% year-on-year, and has maintained a growth rate of more than 10% for two consecutive months. Among the 30 major chemical products under key monitoring, more than 70% of the products have a faster growth rate than the first quarter (including Some products have slowed down.) In April, most chemical product prices continued their upward trend in the first two months. According to the statistics of the China Logistics Purchasing Association, the price of major chemical products in the month rose by 7.3% from the previous month. The prices of 42 major chemical products monitored by China Chemical Network were 25 higher than those at the end of March, 9 were unchanged from the end of last month, and only 8 were down. The quarterly reports of 33 chemical listed companies in Shenzhen and Shanghai showed that the net profit in the first quarter was 680 million yuan, although the year-on-year decline was 19.5%, but the chain growth was 1.12 times. 2. The equipment industry is driven by favorable policies and market demand, and the equipment industry is showing a recovery growth trend. From January to April, the added value of the equipment industry increased by 7.3% year-on-year; in March and April, it increased by 10.1% and 9.7% respectively, both faster than the last two months of last year and January-February this year, and higher than the overall industrial growth rate. The equipment industry accounted for 18.7% of the total industrial added value.

The growth of automobile production and sales is strong. According to the statistics of China Association of Automobile Manufacturers, from January to April, the company produced 3.723 million vehicles and sold 3.382 million vehicles, up 6.4% and 9.4% respectively year-on-year; of which, 1.157 million were produced in April, and 1.153 million units were sold, up 17.9% respectively. And 25%, production and sales have remained at more than 1 million vehicles for two consecutive months. Thanks to the halving of the purchase price of passenger cars of 1.6 liters and below, from January to April, sales of 2.06 million passenger cars of 1.6 liters and below were increased by 30.4% year-on-year. The mid-to-high-displacement sedan showed signs of recovery. In April, the sales volume of 1.6-liter to 2-liter (inclusive) and 2-liter to 2.5-liter cars increased by 2.2% and 5.2% respectively from March. The improvement in production and sales brought about an increase in industry benefits. In the first quarter, 19 key automobile manufacturers (operating income accounted for about 50% of the whole industry) realized a profit of 10.8 billion yuan, a year-on-year decrease of 48.8%, a decrease of 11% over the previous two months. Percentage points.

The growth of automobile production and sales is strong. According to the statistics of China Association of Automobile Manufacturers, from January to April, the company produced 3.723 million vehicles and sold 3.382 million vehicles, up 6.4% and 9.4% respectively year-on-year; of which, 1.157 million were produced in April, and 1.153 million units were sold, up 17.9% respectively. And 25%, production and sales have remained at more than 1 million vehicles for two consecutive months. Thanks to the halving of the purchase price of passenger cars of 1.6 liters and below, from January to April, sales of 2.06 million passenger cars of 1.6 liters and below were increased by 30.4% year-on-year. The mid-to-high-displacement sedan showed signs of recovery. In April, the sales volume of 1.6-liter to 2-liter (inclusive) and 2-liter to 2.5-liter cars increased by 2.2% and 5.2% respectively from March. The improvement in production and sales brought about an increase in industry benefits. In the first quarter, 19 key automobile manufacturers (operating income accounted for about 50% of the whole industry) realized a profit of 10.8 billion yuan, a year-on-year decrease of 48.8%, a decrease of 11% over the previous two months. Percentage points. The process of agricultural machinery going to the countryside has accelerated. According to the statistics of the Ministry of Agriculture, as of April 30, the central government has issued 10 billion yuan of subsidies for the purchase of agricultural machinery. In fact, 1.2 million households have been subsidized, 6.16 billion yuan have been funded, and 1.32 million sets of agricultural machinery have been subsidized. Driven by market demand, in January-April, the production of large and medium-sized tractors increased by 50% and 33.2%, respectively, and crop harvesting machinery and on-the-spot machinery increased by 33% and 25.8% respectively.

Special equipment is accelerated by investment. From January to April, investment in chemical raw materials and products, printing and railway transportation increased by 34.1%, 19.8% and 94.2% respectively in the national fixed assets investment. Driven by the substantial increase in investment, the output of special equipment for refining and chemical production increased by 25.6% year-on-year, the output of printing special equipment increased by 21.9%, and the output of railway passenger cars increased by 1.68 times.

The production and sales situation of construction machinery improved. Since the beginning of March, with the large-scale construction of various domestic engineering projects, the demand for construction machinery has rebounded significantly, and the domestic sales situation is better than exports. In the first quarter, it sold a total of 24,027 excavators and 31,375 loaders, of which 13,314 units and 16,792 units were sold in March, accounting for more than half of the sales in the first quarter; cumulative sales of bulldozers and cranes exceeded 2,000 and 7,000 units respectively, including March. It sold more than 800 sets and more than 3,000 sets respectively. In April, the average daily output of cranes increased by 4.1% compared with March, and the increase of loaders, conveyors, excavators and compaction machinery was 12.6%-50.6%.

The machine tool industry is in an adjustment period. From January to April, the output of metal cutting machine tools and metal forming machine tools decreased by 20.5% and 20.2% respectively. Among them, CNC metal cutting machine tools and CNC metal forming machine tools decreased by 18.7% and 8.3% respectively. The overall machine tool industry is still in decline. Many enterprises have reflected that the effects of policies and measures such as the expansion of domestic demand and the implementation of key industries adjustment and revitalization plans are being transmitted to the machine tool industry through the upstream industry. Machine tool orders have rebounded in the past two months, and demand for high-end CNC machine tools has increased, but small and medium-sized ordinary machine tools The market situation is still not optimistic. From the production situation in April, although the output of metal cutting machine tools and forming machine tools decreased by 21% and 34%, the daily output of the month increased by 5.1% and 17.7% respectively compared with March.

3. The steady growth of the domestic market of the consumer goods industry has partly compensated for the impact of insufficient external demand and the decline of exports. The operation of the consumer goods industry is relatively stable, which has played a positive role in promoting the steady recovery of industry. From January to April, the added value of the consumer goods industry increased by 8% year-on-year, with a growth of 9.8% and 9.2% in three and four months. Among the major industries, the light industry, textile, tobacco and pharmaceutical industries increased by 8.1%, 6.6%, 6.1% and 13.8% respectively. The added value of the four industries accounted for 18.7%, 6.3%, 3% and 2.4 respectively of the total industrial added value. %, a total of 30.4%.

The light industry and textile industry are running smoothly. Under the unfavorable situation that the international market is shrinking and exports are blocked, the light industry and textile industry are based on the domestic market, and the overall operation has maintained a good momentum of steady recovery. In April, the added value of the light industry increased by 9.8% year-on-year, 0.4 percentage points higher than that in March. The growth rate of agricultural and sideline food processing, food manufacturing and beverage manufacturing reached 13.2%-19.2%. In the three months and four months, the growth rate of the textile industry exceeded 8%, which was higher than the monthly level in the fourth quarter of last year, in which clothing and footwear manufacturing reached a growth rate of 10%.

The decline in the decline in exports of textile products has slowed down. From January to April, the export delivery value of light industry and textile industry decreased by 10.9% and 8.4% respectively year-on-year, which was less than the overall industrial export decline of 4.8 and 7.4 percentage points respectively. Judging from the changes in the monthly export delivery value growth rate, the trend of the slowdown in the export of textile products in March and April has been initially contained.

The decline in the decline in exports of textile products has slowed down. From January to April, the export delivery value of light industry and textile industry decreased by 10.9% and 8.4% respectively year-on-year, which was less than the overall industrial export decline of 4.8 and 7.4 percentage points respectively. Judging from the changes in the monthly export delivery value growth rate, the trend of the slowdown in the export of textile products in March and April has been initially contained.  The effects of expanding consumer policies such as “home appliances going to the countryside†are gradually emerging. From January to April, among the 14 major household electrical appliances that were mainly counted, there were 8 kinds of growth, of which refrigerators and rice cookers increased by 7% and 8.1% respectively, and water dispensers and gas cookers increased by 22% and 20.3% respectively. In order to speed up the promotion of home appliances to the countryside, on April 16, the Ministry of Finance, the Ministry of Commerce, the Ministry of Industry and Information Technology and other departments jointly issued the "Detailed Implementation Rules for Home Appliances to the Countryside" to further simplify the subsidy payment procedures. In April, the average daily output of 14 major household electrical appliances increased by 10 compared with that of March, of which 8 were growth rates exceeding 10%. According to the statistics of the Ministry of Commerce, from January to April, the total sales of home appliances in the countryside was 4.46 million units, and the sales amount reached 6.8 billion yuan.

The effects of expanding consumer policies such as “home appliances going to the countryside†are gradually emerging. From January to April, among the 14 major household electrical appliances that were mainly counted, there were 8 kinds of growth, of which refrigerators and rice cookers increased by 7% and 8.1% respectively, and water dispensers and gas cookers increased by 22% and 20.3% respectively. In order to speed up the promotion of home appliances to the countryside, on April 16, the Ministry of Finance, the Ministry of Commerce, the Ministry of Industry and Information Technology and other departments jointly issued the "Detailed Implementation Rules for Home Appliances to the Countryside" to further simplify the subsidy payment procedures. In April, the average daily output of 14 major household electrical appliances increased by 10 compared with that of March, of which 8 were growth rates exceeding 10%. According to the statistics of the Ministry of Commerce, from January to April, the total sales of home appliances in the countryside was 4.46 million units, and the sales amount reached 6.8 billion yuan. 4. The electronics manufacturing industry is highly extroverted (the export value of the first four months accounted for 64.2% of the industry's sales value), and the electronics manufacturing industry is one of the industries most affected by the international financial crisis. . From January to April, the added value of the electronics manufacturing industry fell by 3.7% year-on-year. From March to April, it increased by 1.2% and 1.1% respectively, but the prospect of recovery is still unclear.

The decline in exports has not changed fundamentally. According to customs statistics, in January-April, the export of electronic information products was 120.7 billion US dollars, down 24.1% year-on-year; of which, it fell by 22.9% in April, a decrease of 0.8 percentage points over March.